What is Lithium?

Lithium / lith-i-um / noun – a light, soft, silver-white metallic chemical element.

What is it used for?

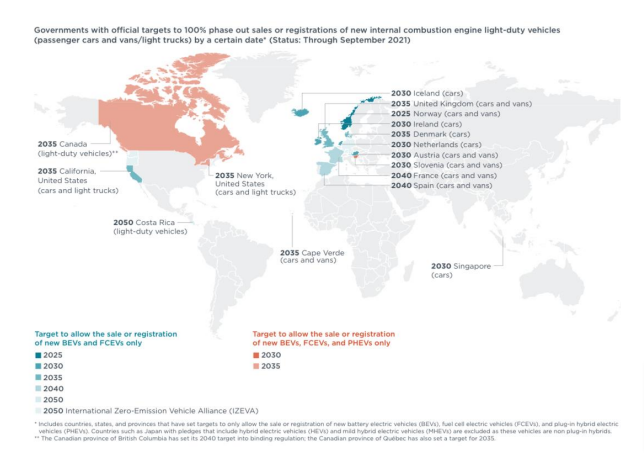

When Henry Ford took to the streets with his Ford T he produced 15 million units between 1908 and 1927 that put the world in motion, literally. Since then, oil has had its place in the new world, but recently that

has been starting to change and the pace of that change is ever increasing. Many countries have committed to the ending of the sales and registrations of ICEs (Internal Combustion Engine). Targets between 2030 and 2040, if reached, would completely eradicate ICE sales and have them replaced by EVs.

For the foreseeable future, lithium-ion will be the leading technology in the electric vehicle (EV) industry. With the surging fuel prices across the world and increasing pollution levels in the environment, many countries across the globe have started investing in lithium-ion technology which is used as a substitute for conventional fuel vehicles in the market. With lesser manufacturing costs and high-performance delivery, lithium batteries are considered to be the best choice in modern electric vehicles. With growing applications of lithium batteries in aerospace and military operations, the market is considered to grow at least until 2030.

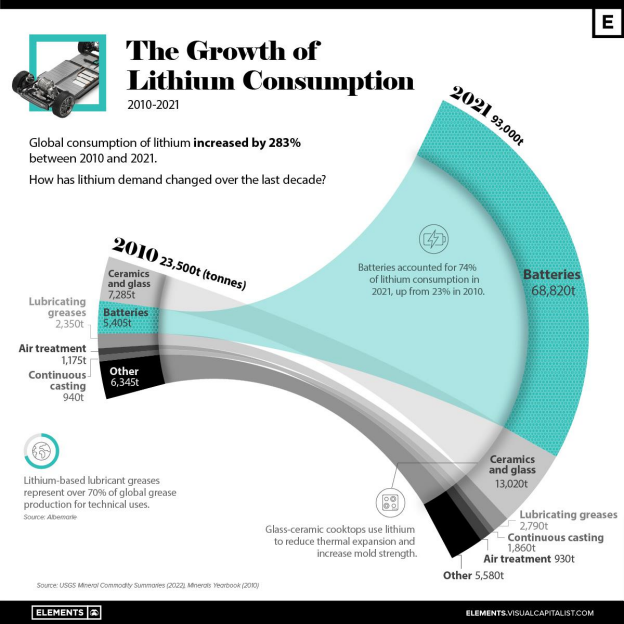

According to USGS data in 2021, the uses of Lithium today can be broken down as follows,

| Batteries | 74 | % |

| Ceramics and glass | 14 | % |

| Lubricating greases | 3 | % |

| Continuous Casting | 2 | % |

| Air Treatment | 1 | % |

| Other | 6 | % |

Lithium has become the “new oil” and everyone is scrambling to take part in this new greener storage of energy. With the reservations around EVs, namely mileage, reliability and cost being answered in quick succession the consumer has gradually come to the realization that EVs are a sustainable choice. This has led to the demand driven situation we find ourselves in today. Lead times on EVs have gone from 3 weeks to 8—12 months and this will only get worse as our appetite for Lithium ion-based storage from everything from cars to laptops increase

According to Grand View Research, the breakdown of Lithium use in batteries today is as follows

| Electric cars | 15 | % |

| Consumer electricals | 27 | % |

| Energy storage | 23 | % |

| Industrial | 35 | % |

With the inevitable move towards mainstream EVs, the above 15% will rise significantly, as will the 74% attributed to batteries in the first set of figures. We already see car makers scrambling to obtain Lithium units for their future production, Elon Musk even suggesting that Tesla will have to move into Lithium mining to secure feed.

Where is Lithium found?

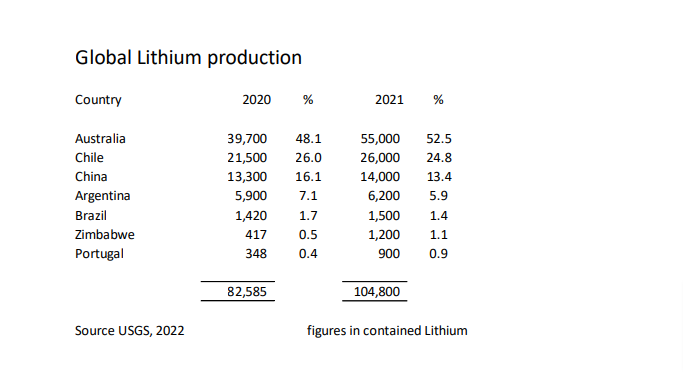

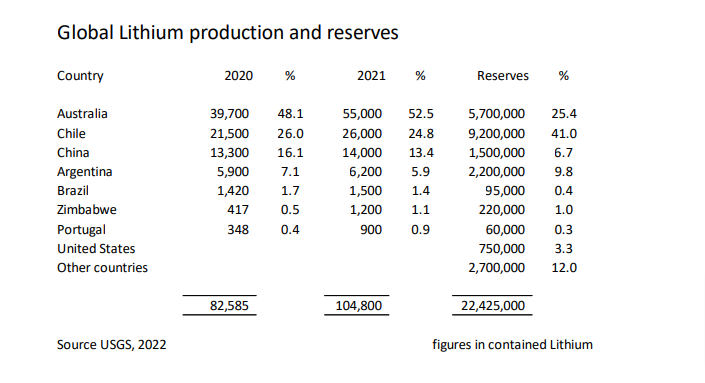

The predominantly hard rock mining in Australia accounts for over half of todays’ global Lithium production. However, with only 5.7 million tons of reserves, reliance on Australia is about to diminish. Lithium is typically found either in Hard Rock and as such is mined to produce first a spodumene and latterly Lithium Hydroxide, or in Brine, using numerous chemicals and vast quantities of water to extract a Lithium Carbonate through a lengthy process of evaporation.

Chile’s production is derived from the Brine variant. When looking at global reserves of Lithium, the Brine process takes on more significance. This trend is even more pronounced when looking at identified resources, where over 70% of these resources are located in the Lithium Triangle of Chile, Bolivia and Argentina (all Brine processes). We will address the significance of this trend later in the document.

Are there enough Lithium reserves in the world?

Is there enough Lithium in our earth’s crust to cover our current and future needs as we go into this green revolution? The simple answer is yes, but does that mean we can get the Lithium in the form required at the right time, to the consumers that need it?

At the United Nations Climate Change Conference, UK 2021 – COP26, the transition to zero emission vehicles was championed and what this brought to the forefront was that the OEM and car manufacturers would need to adapt, finance and collaborate to reach these goals. This set the tone for the future demand forecasts we hear about today in the lithium space. If 2040 is to become a reality, we would require a 10-to-13 fold increase in lithium production.

It is somewhat ironic, with the environmental push towards EVs moving ahead with great momentum, that the majority of Lithium will be produced to supply this huge demand, in the form of Lithium Carbonate, through the Brine process. At what environmental cost will these projects come into fruition, given the vast amounts of chemicals required and enormous water resources needed? Clearly care needs to be taken and it is estimated that 90% of water used is re-cycled back into the environment. One has to believe that environmental considerations will be front and foremost in producers minds, but will legislation slow the “resource to production” timeline further?

What is the difference between Lithium Carbonate and Lithium Hydroxide and why does it matter?

Lithium hydroxide is a lithium-based compound with a crucial distinctive property compared to lithium carbonate: it decomposes at a lower temperature, allowing the process of producing battery cathodes to be more sustainable and the final product to be long lasting.

For this reason, lithium hydroxide is preferred in the battery manufacturing industries, especially in EV (electric vehicles) production. It increases the performance of the battery, allowing EVs to have a higher usability range before needing a recharge.

Will reserves and identified resources be produced in time to meet increased demand?

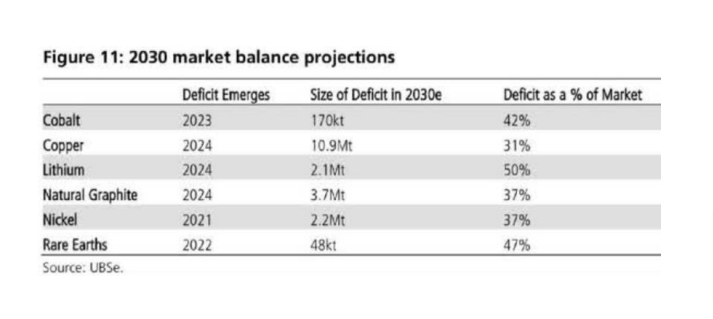

Will supply meet demand in time? Certainly, if we talk about 2040, there is time to turn identified resources into proven reserves and move these projects into production. However, the shortfall in the coming years is clear and sizeable.

Lithium-ion Batteries represent 74% (this number is forecast to reach 90% in 2030) of the consumption for lithium. Demand for EVs, with global sales of 3millions in 2020 to 4,69millions in 2021, is projected to reach 15 million by 2030. Also, with an average of 38Kg of lithium hydroxide for each EV battery (4’690’000*38Kg) 0,56% hydroxide = 99’803Mt1 for 2021 consumption only. With a production representing 103Mt for 2021. And for 2030 (15’000’000*38Kg*0,56), we will need = 319’000Mt to satisfy only the need for EV. There will also be plenty of other utilization of Lithium for energy storage in the near future.

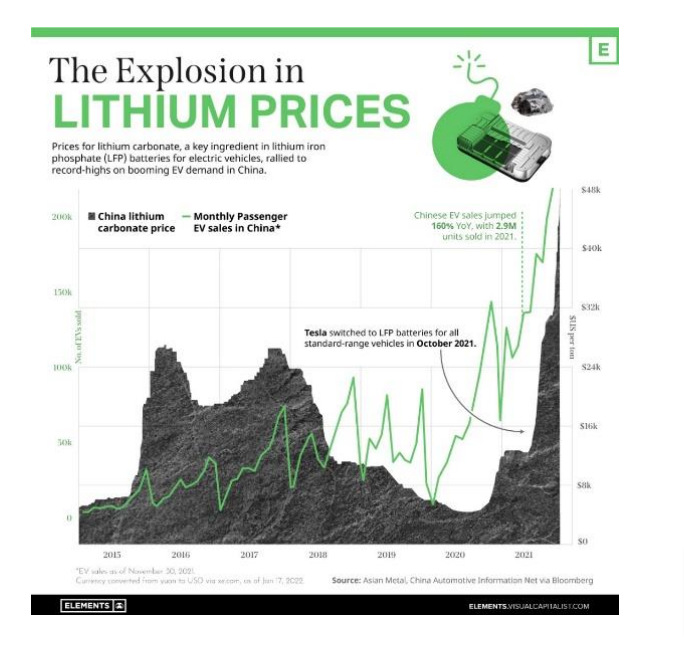

Conclusion – higher prices are inevitable

Many articles have been written about the shortage of Lithium. The consensus of opinion is not “if” it will happen, but “when”. The crucial shortage appears to be as early as 2025 and whether this shortagelasts decades or more, relies heavily on the conversion of Lithium assets into producing assets. The lead time for bringing these projects on is the main problem.

Car makers are obviously seeing the “car crash” (please excuse the pun) that is just around the corner. Almost every car maker is or intends to produce EVs and their very livelihoods depend on it. As the impending shortage becomes more and more apparent, companies are realizing that it is not simply a question of whether they will have to pay more for the Lithium to produce their cars, but will the Lithium be available at all. Stockpiling is already taking place and expect to see more from the more pro-active in the industry. However, such stockpiling also has a significant upwards pressure on prices.

Therefore, three distinct factors will contribute to Lithium price rises in future (i) the fundamentals, there is enough Lithium in the ground, but not enough will be produced in time to meet demand (ii) Stockpiling for fear of EV waiting lists becoming catastrophic and (iii) investor sentiment / speculative investors.

It is not our job to predict future Lithium prices, however, expect to see more graphs like the one below in years to come.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.